Optimize and save your operation costs through the use of advanced forecast and cost optimization algorithm.

To ensure cash availability in ATMs, bank branches often deploy large management teams. Despite these efforts, they continue to face challenges due to fluctuations in cash usage and customer demand, resulting in high replenishment and recycling costs.

ATMs represent a strategic point of contact for banks any downtime or unavailability leads to customer dissatisfaction, loss of clientele, and decreased revenue. To address these challenges, Atm-View offers an innovative and intelligent solution that enables banks to optimize cash management, reduce operational costs, and enhance customer satisfaction through improved ATM availability.

Atm-View now harnesses the power of artificial intelligence to accurately anticipate cash requirements. Through real-time data analysis, the AI learns how customers use each ATM (daily, weekly, monthly) and adapts to seasonal variations.

This approach is based on:

Optimize and save your operation costs through the use of advanced forecast and cost optimization algorithm.

Atm-View now harnesses the power of artificial intelligence to accurately anticipate cash requirements. Through real-time data analysis, the AI learns how customers use each ATM (daily, weekly, monthly) and adapts to seasonal variations.

This approach is based on:

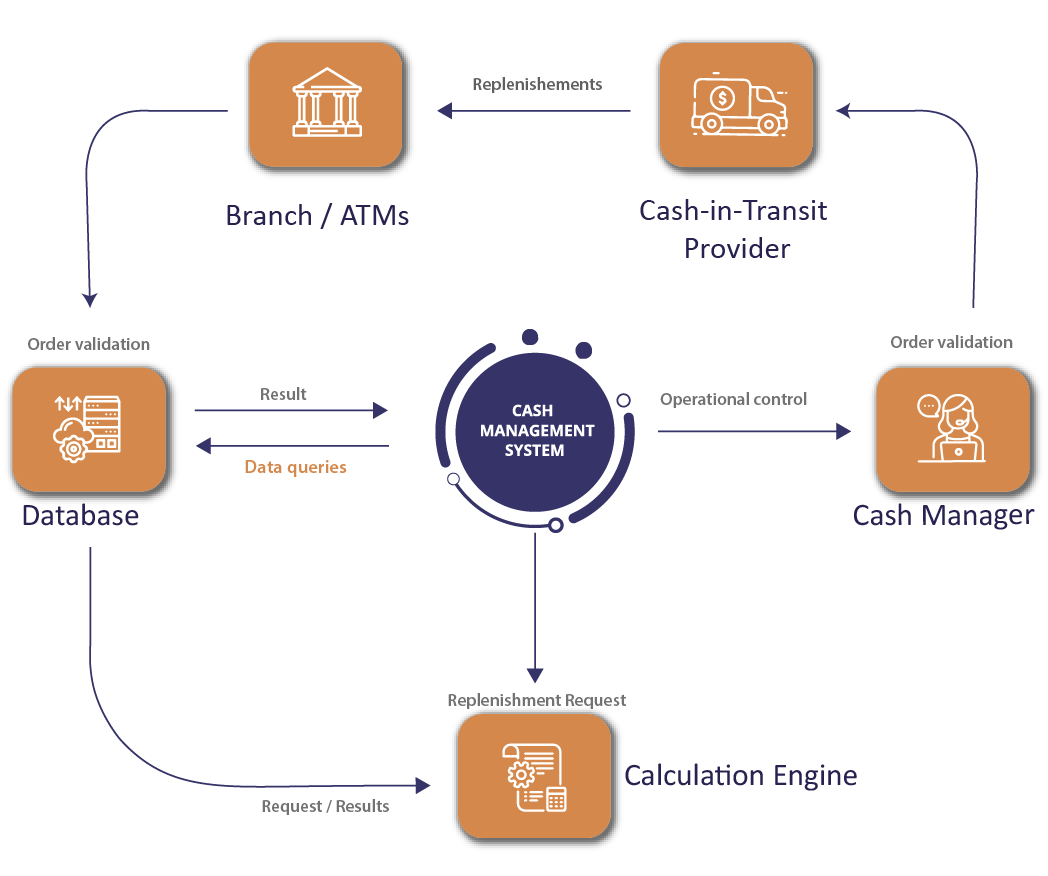

With Atm-View, the cash replenishment process becomes automated and simplified to just the press of a button. The treasury manager is freed from manual spreadsheets and complex calculations thanks to an intelligent calculation engine based on multiple cost-optimization models. The solution covers the entire cash cycle, from replenishment to reconciliation, ensuring complete and transparent monitoring. It also includes a management and configuration module, allowing adjustment of entities as needed.

of the system and provides a clear overview of:

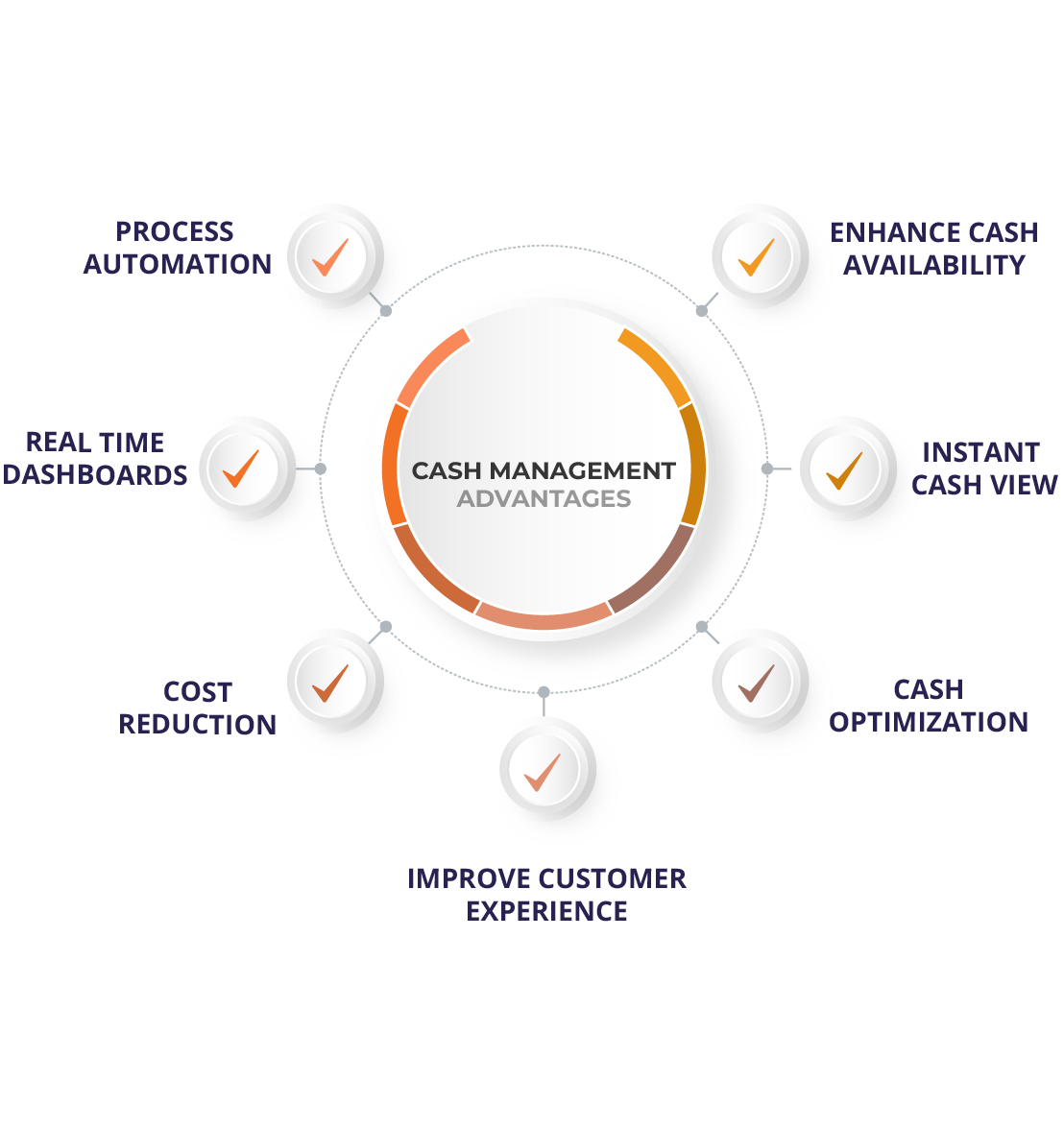

By providing accurate forecasts, robust optimization, and real-time visibility of the ATM network, Atm-View enables banks to solve the complex equation of optimized cash management. This approach ensures continuous, transparent, and efficient control, capable of overcoming the main challenges in treasury management.

each bank uses a special Atms type as well as each type has its special capacity ,number of cassettes and maximum number of tickets by distribution.

time of sending and executing orders differ from one Cash provider to another. to ensure that replenishment orders will be executed in a timely manner as well as respect constraints of cash provider those parameters have to be configured properly.

Optimization rate ,cost of replenishment and profitability rate are an important parameters that must be taken into account in order to reduce costs and raise the profitability of banks

minimum amount of replenishment order and minimum amount of replenishment order must be configured to avoid wastefulness.

It allows also a clear overview of the components and overall status of ATMs and their event as well as it provides a Standard report for orders, machine availability, returns, supply shortfalls, stops. By Implementing a reliable solution with accurate forecast, robust optimization, real time visibility of ATM networks, banks can finally solve the complex equation of cash optimization and ensure transparent and actionable control regime that overcome the seven hinders of ATM cash management.

With this solution, banks can:

Automated replenishment schedules adjust to consumer behavior, holiday periods, or special events, thereby minimizing costly CIT visits and idle cash.

The days when multiple employees managed cash manually are over. Now, a single manager can oversee the entire process, while the rest of the team focuses on higher-value tasks, enabling proactive and strategic management of banking operations.